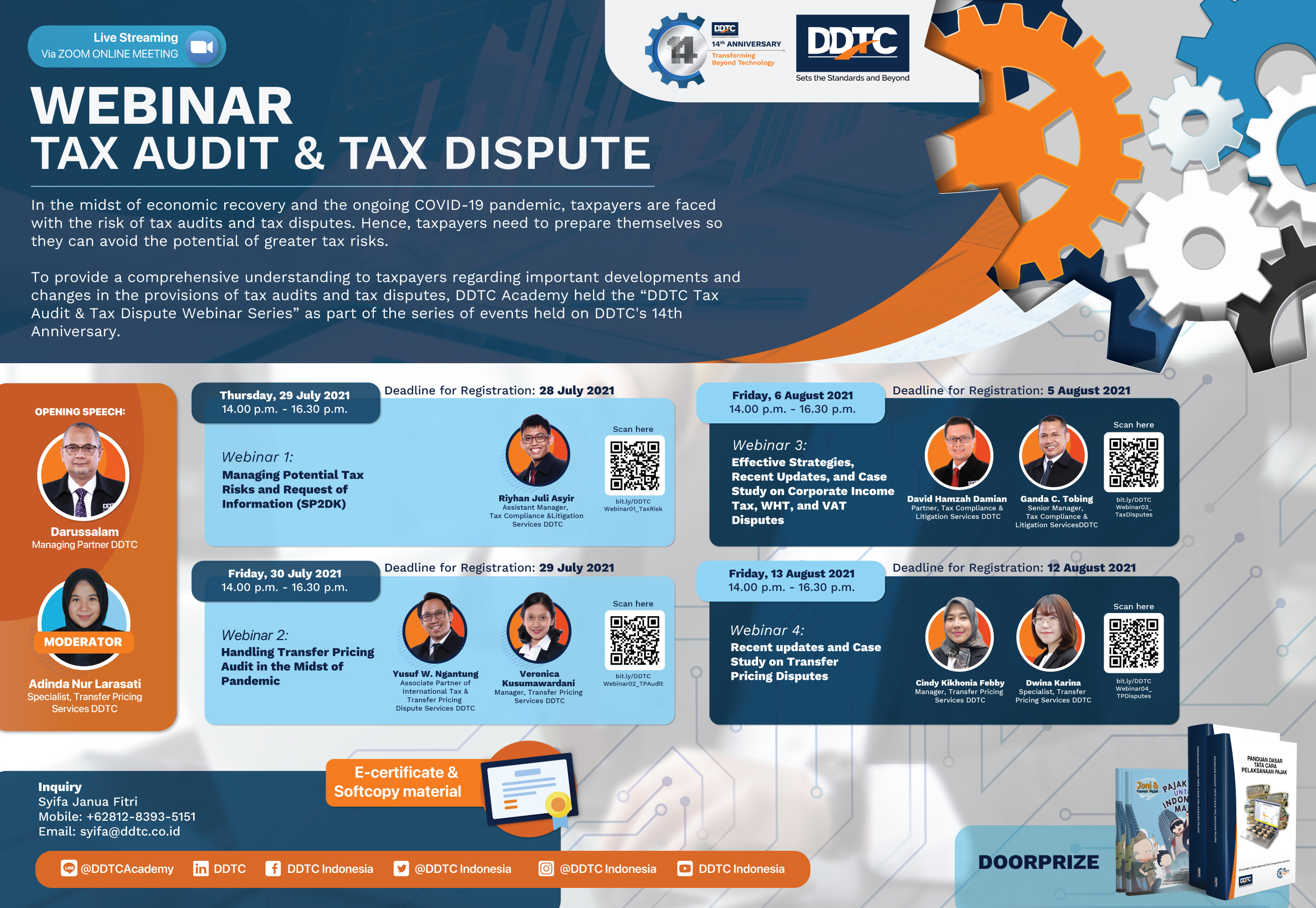

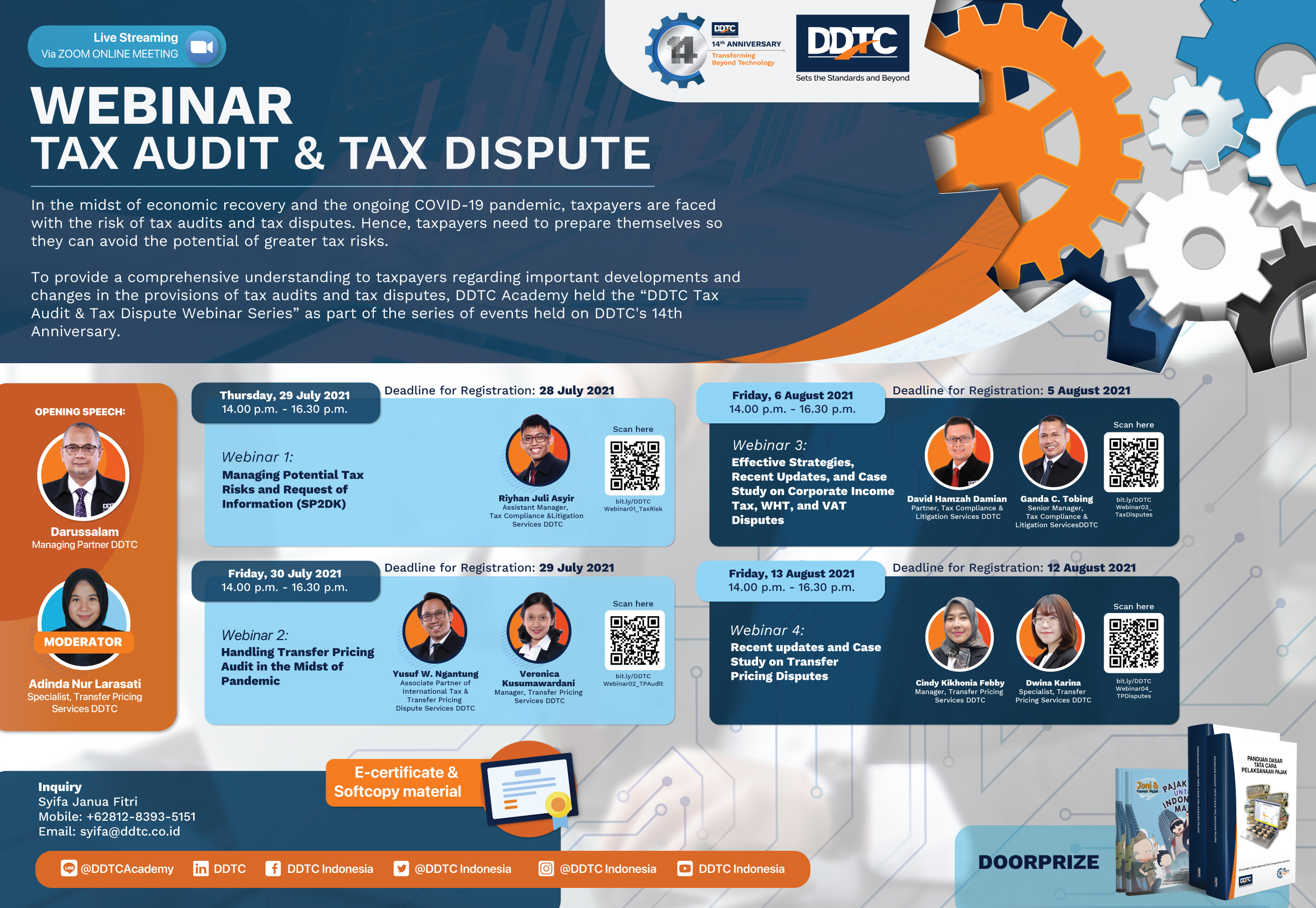

Webinar Seri Tax Audit and Tax Dispute 3: Effective Strategies, Recent Updates, and Case Study on Corporate Income Tax, WHT, and VAT Disputes

Free Events

Webinar Seri Tax Audit and Tax Dispute 3: Effective Strategies, Recent Updates, and Case Study on Corporate Income Tax, WHT, and VAT Disputes

Jadwal

Jumat, 6 Agustus 2021

02.00 p.m. - 04.30 p.m.

Live streaming via ZOOM ONLINE MEETING

Informasi Lainnya

Overview:

The DGT has issued various new tax policies in order to ensure the tax revenues remain optimal, in response to the pandemic and political policies from foreign countries. Those include new income tax, WHT, and VAT policies which potentially affect tax disputes and deserve extra attention from taxpayers. This webinar is intended to give insights regarding recent updates about corporate income tax, WHT, and VAT disputes and how to plan effective strategies for it.

Topics Covered:

- 2021 latest and substantial corporate income tax, WHT, and VAT regulation updates

- Case study on corporate income tax, WHT, and VAT disputes

- Effective planning of corporate income tax, WHT, and VAT strategy

Opening Speech:

Darussalam, S.E., Ak., CA., M.Si., LL.M Int. Tax.

Managing Partner DDTC

Moderator:

Adinda Nur Larasati, S.E., B.Com.

Specialist Transfer Pricing Services DDTC

Program ini telah selesai

Nantikan program kami berikutnya atau cek program lainnya.